The Impact of the Intermodal Transport Infrastructure Connectivity on Foreign Direct Investment in the European Union

Abstract

In this paper we propose to evaluate the impact of intermodal connectivity of transport infrastructures on foreign direct investments in the European Union. In this context, we will demonstrate the hypothesis that the density of network nodes is more important than the size of networks to attract external investors. The impact assessment pursues two objectives: to quantify the extent to which intermodal connections influence the volume of foreign direct investment in the Member States of the Union and to spatially prioritize the construction/interconnection of infrastructures in the European space. Knowing the impact of spatial accessibility given by intermodal connection on attracting foreign direct investment is a mandatory element for substantiating transport policies in each EU member country. The volume of foreign direct investment is directly proportional to the degree of interconnection of transport infrastructure, which give the intermodal nodes the role of territorial and economic cohesion agents at the scale of the community space. The intermodal connectivity gap creates the map of the investment deficit risk, due to the reduced attractiveness of the respective spaces. Therefore, spatial differences in the endowment of intermodal nodes hierarchize spatial priorities for the interconnection of transport networks.

JEL Classification: F20; F21; R41; R42

Table of contents

1. Introduction

2. Problem Statement

3. Research Questions/Aims of the research

4. Research Methods

5. Findings

6. Conclusions

1. Introduction

Foreign direct investment (FDI) is one of the main drivers of regional economic growth and of the achievement of territorial and economic cohesion in the European Union (Eurostat,2017a, p. 37-38).

The spatial accessibility provided by the endowment of flexible and efficient transport infrastructure is a decisive regional asset for attracting foreign direct investment along with other favourable factors such as market size, innovation capabilities and the R&D level of the region, degree of urbanization, taxation level, labour education, administrative and bureaucratic flexibility (Blomström & Kokko, 2003, p. 39-40, Copenhagen Economics, 2006, p. 4, 18).

Within this framework, we intend to analyse the effects of intermodal connectivity of transport infrastructure on foreign direct investments in the European Union. The intermodal connectivity is given by the existence of network nodes in which interconnection lines belonging to different categories of infrastructure (road, rail, air, river and maritime) are interconnected.

2. Problem Statement

The role of intermodal connections in transport networks is analysed in the literature by three elements of interest: contribution to cost reduction, reduction of transport time and approach to environmental friendly relations (Kreutzberger et al., 2003, p. 2-3 Janic, 2007, p. 34).

The evaluations aim at substantiating the most appropriate proposals for optimizing transport costs through network interconnection (Macharis et al., 2010).

According to Piet Rietveld, intermodal connections are among the determinants of the space economy; the author makes a comparative assessment of investments made in transport infrastructure and foreign direct investments at regional level (Rietveld & Bruinsma, 1998, p. 7) and suggests taking into consideration intra-modal links along with intermodal links (Rietveld & Bruinsma, 1998, p.162) as a tool for the flexibility of freight and passenger flows (I.U.R., 2017).

The beneficial economic effects of intra-modal connections are also shown in a case study on the German railway infrastructure, in which Harald Rotter proposes intra-modal connection of large railways in large nodes (mega-hubs) to shorten the transhipment time of goods and increase the volume of transport in the time unit (Rotter, 2010, p. 348).

Transport integration in the European Union is seen by Dominic Stead and Moshe Givoni as a necessity for the configuration of the European body’s blood network, capable of sustainably satisfying current economic development requirements in terms of economy and environmental protection (Stead, 2010, p. 16).

The integration of road and rail transport networks is defined in the literature as a priority of the applied research in the field of transport economics and geography, aiming to open the agenda of a newly created field-intermodal applicative research (Bontekoning et al., 2004).

The emergence of transport is an analysis line in which applied research should provide proposals to identify the shortest transport routes on which the largest quantities of goods can be traded (Macharis & Bontekoning, 2004).

For the Eastern European countries which acceded EU after 2004, the modernization and development of intermodal interconnection infrastructure appears to be one of the most important ways of economic growth and attraction of foreign investment along with technological innovation and the establishment of modern logistics centres (Šakalys & Palšaitis,2006, p. 148-149; European Commission, 2013).

Also, the issues of accessibility and territorial cohesion given by the spatial and intermodal connectivity of transport networks have been extensively evaluated by Ana Condeco- Melhorado (2014), Michael Baun and Dan Marek (2008) and David A. Hensher (2004).

Romanian academic literature has, in the last period, dealt mainly in terms of the technical aspects with the impact of intermodal connections on freight and passenger traffic in the European Union and on attracting investments.

The evaluation of technical and economic advantages of the combined transports has substantiated the proposal for solutions for the efficiency of intermodal transhipment activities (Dragu, 2009, p. 171).

A less used approach in the literature is the quantitative assessment of the impact of intermodal connectivity on foreign direct investment from the perspective of identifying vulnerable spaces in terms of infrastructure equipment. In this context, we propose to carry out an impact analysis in order to identify deficiencies and proposals for spatial prioritization of intermodal connection works.

3. Research Questions/Aims of the research

Knowing the impact of intermodal interconnection of transport networks on investment is an essential issue for prioritizing community and national policies in the field of infrastructure. We therefore propose the following objectives:

- quantifying the extent to which intermodal connections influence the amount of foreign direct investment in the Member States of the Union;

- identifying the areas where infrastructure interconnection needs to be accelerated, as means of the spatial accessibility to attract investors. Achieving this research goal will help substantiate decisions and options regarding networks interconnection.

The research hypothesis from which we start is that the intermodal interconnectivity of transport networks is more important than the size of these networks to attract external investors’ attractiveness.

4. Research Methods

In this chapter the author should present and discuss the research methods used in obtaining data/results. We suggest the detailing of the research methods, of the period of application, the means of application, the sample, methods, etc.

The elements of transport interconnection are represented by intermodal nodes connecting the following infrastructure elements: highways, high-speed railways (allowing running speeds over 200 km/h), airports, maritime and river ports.

Intermodal nodes have been identified by authors by the interpolation method of thematic maps of the four types of infrastructure (European Commission, 2017).

Depending on the level of connection they perform, we used the following hierarchy of intermodal nodes:

• 54 first order intermodal nodes (main nodes) represent existing points along the trans- European TEN-T network in which elements of all network categories converge; they equip the territories of 14 states and polarize economic activities.

• 412 intermodal nodes of the second order (intermediate nodes) represent the interconnection points of three out of the four categories of networks; they are found on

25 states’ territories.

• 870 third order intermodal nodes (primary nodes) connect two out of four networks and are found in all the EU countries. They are the basic synapses of the interconnection of transport infrastructures. Their relevance stems from the fact that, although they do not have the polarizing valences of the first and second order nodes, they are the most widespread in the territories and thus contribute to connecting less developed regions and diminishing interregional cleavages. Thus, the primary nodes are in fact the small and “silent” contributors, but the most significant for achieving territorial cohesion in the EU.

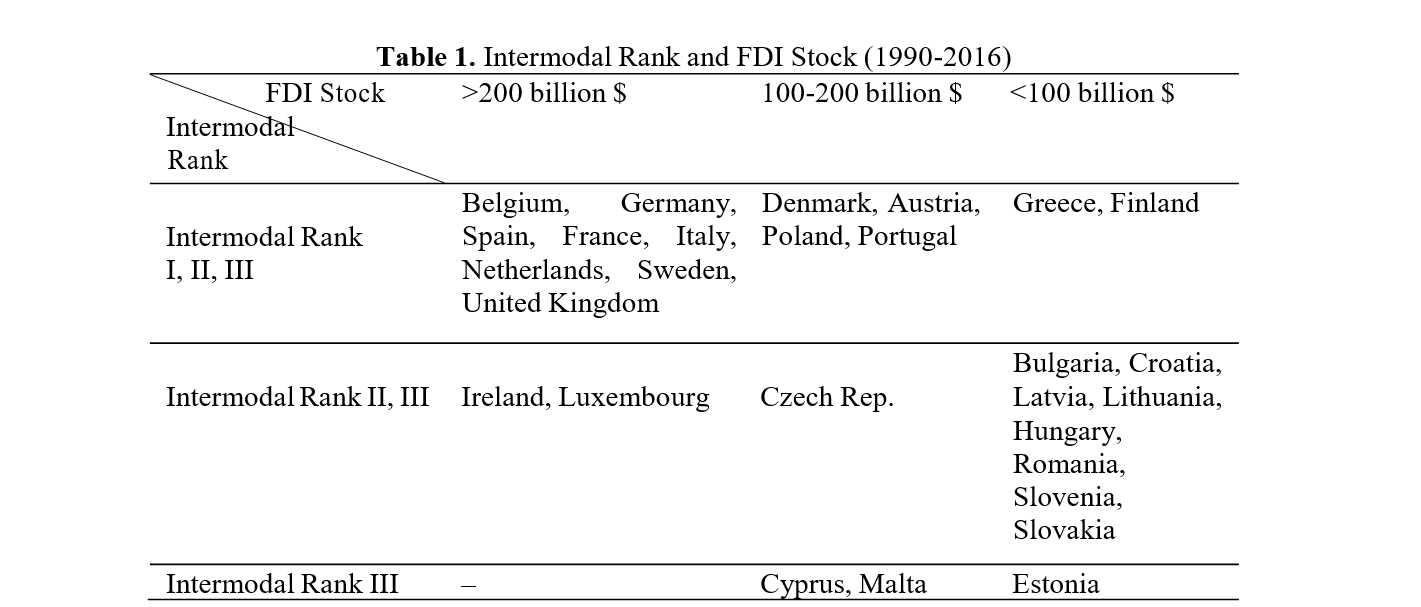

In order to quantify the foreign direct investments, we used the FDI stocks in EU at the level of 2016 (1990-2016), accessed from the UNCTAD database. The relationship between territorial equipment with intermodal nodes and the volume of FDI received follows the model of an overlapping geography (Table 1): the spaces with the largest quantity of FDI are endowed with higher interconnecting nodes, while at the opposite pole, the lowest the connectivity degree, the lowest the FDI volume.

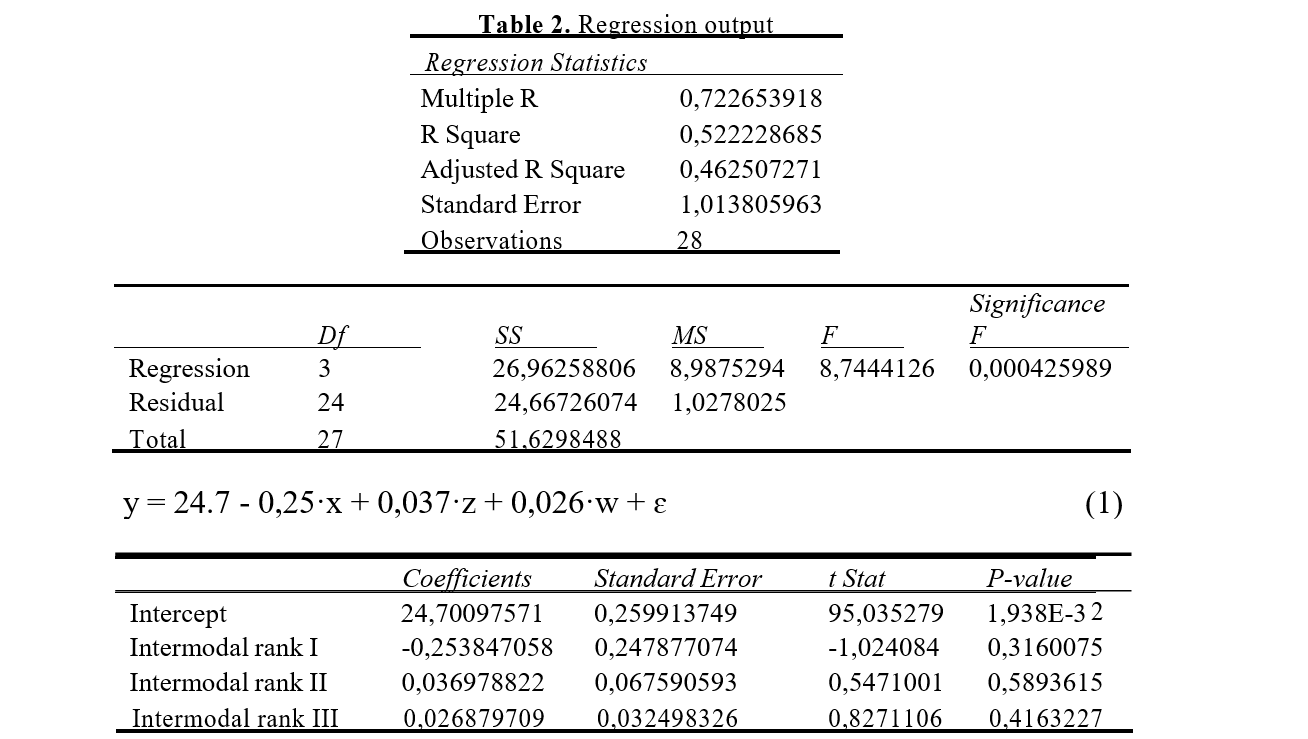

In order to perform the quantitative evaluation of the relationship between the intermodal connectivity of transport infrastructures and FDI we used the multiple regression method of FDI (as dependent variable) depending on the number of intermodal nodes of first, second and third orders (as independent variables) (Table 2); we logged the FDI values.

The multiple relationship hypothesis is correct because the value of the significance factor (F-statistic) is less than 0.05 (it is in fact 0.00042), so it is possible to assert with a probability of over 99% that there is a strong link between the variables.

However, we acknowledge that due to the rather small sample (only 28 values corresponding to the 28 EU Member States) the p-values of the parameters (excluding the intercept) may lie above the significance level, the model itself still remaining trustworthy.

The existence of intermodal transport networks nodes explains 46.2% of FDI in each EU member, according to the adjusted correlation coefficient R²=0.462507271.

This percentage highlights the major role of intermodal connections in attracting foreign direct investment; practically all the other factors that determine the attractiveness of FDI (qualification of labour force, flexible administrative-bureaucratic framework, innovative environment, etc.) influence all together the motivation of direct investors in a weight of 53.8%.

The correlation between FDI and the number of first order intermodal nodes is indirect and negative across the Union, given the negative value of the coefficient a=-0.25, due to the fact that half of the Member States do not have this type of high-level interconnections.

In contrast, for the other 14 states, their contribution is immense, emphasizing their role in polarization of regional development: each existing or future first intermodal node will add an extra FDI contribution of USD 0.25 billion, mathematically added to the amount of the residue for each state.

The correlation between FDI and the number of second order intermodal nodes is direct and positive, according to the positive coefficient b=0.037. For the 25 states equipped with this type of interconnection structures, their contribution is significant, underlining their role as mediator of regional development and economic and territorial cohesion: each existing or potential second order intermodal node will bring on average an additional FDI contribution of USD 37 million.

The correlation between FDI and the number of primary intermodal nodes (third order nodes) is direct and positive, according to the positive coefficient c=0.0268; virtually every existing or potential primary intermodal node will add on average an additional FDI contribution of USD 26.8 million.

All Member States of the Union are equipped with this category of intermodal connections, but the interpretation of their contribution to investors motivation has to be clearly defined.

The contribution is relatively modest, but it is particularly relevant for national spaces not equipped with first class intermodal nodes. For these countries, the provision of primary interconnections is the key to attracting foreign investors and therefore a relevant tool to raise the level of regional development and diminishing development disparities.

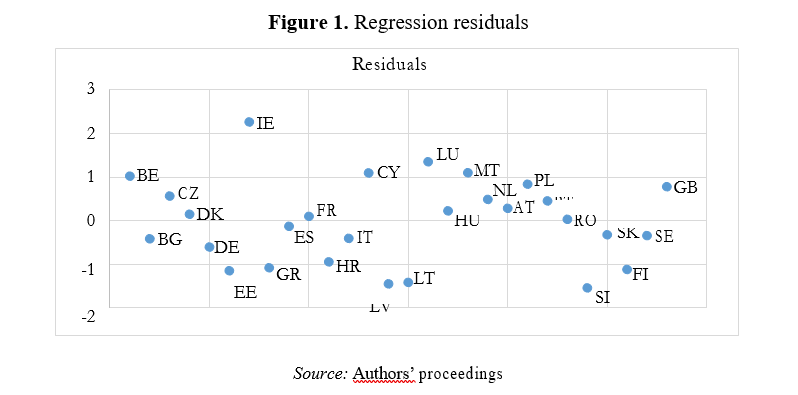

The residuals of regression (ɛ) represent the most interesting parameter of evaluation and interpretation (Figure 1), as it measures the influence of other factors contributing together, as we have shown, in a proportion of 53.8% to FDI.

Positive eccentric residual values (above 1) indicate that for these countries (Ireland, Belgium, Luxembourg and Cyprus) the role of intermodal nodes in attracting FDI is mitigated by many other highly attractive factors: well- qualified workforce, innovative environment, administrative stability.

The more the residual values tend to 0 (in the range ±1), the more the role of intermodal connections in attracting FDI is balanced in relation to other development factors. The negative eccentric residual values (below -1) characterize states for which the network of interconnected nodes, no matter how well structured, is one of the few attractive factors for investors; this category includes some Eastern European states with a certain level of development, such as the Baltic countries, Slovenia and Greece, and Finland where the vastness of uninhabited space and peripheral position within the Union have made intermodal nodes not so numerous.

5. Findings

The distribution of the three levels of intermodal connectivity of transport infrastructures (first, second and third orders) reveals a mirrored “photo” in the FDI distribution: the image of a Union with more levels of investment attractiveness.

The situation is determined, on the one hand, by the polarization of higher order interconnections (first order) in favor of several developed areas in Western Europe that are able to attract the largest volume of FDI.

On the other hand, the convergent role played by primary intermodal connections for the less attractive areas in the East (new Member States after 2004) plus Greece and Finland is highlighted. On this background, the connectivity gap in Europe appears to be more evident, but also the role of lower-order intermodal nodes as an attraction for investors and therefore for the achievement of territorial cohesion.

Within Central and Eastern Europe, Poland is a more evolved area from this point of view (Eurostat, 2017b).

The Polish state managed to set up a first order intermodal node, 5 second order nodes and 17 third order nodes, a real premiere for the countries of the post-2004 accession wave, with a beneficial impact on the reception of FDI.

The distribution of multiple regression residuals is relevant for the prioritization of endowment of interconnection nodes, especially for spaces with no first order intermodal connections or other attractiveness factors.

The lack of intermodal infrastructure connectivity contributes to a low investment attractiveness of these spaces.

Depending on the vulnerability due to the lack of intermodal connections, we propose a hierarchy of spaces that require the multiplication of interconnection connections, highlighting from this point of view two priority spatial categories:

- the most vulnerable spaces in terms of primary intermodal connections are countries with negative residual values of regression and without main intermodal connections, namely Bulgaria, Croatia, Latvia, Lithuania, Estonia, Slovenia and Slovakia;

- the second priority spatial category is represented by the regions without main intermodal connections and for which the regression residuals are positive and below 1, namely Romania, Hungary and the Czech Republic.

6. Conclusions

The spatial accessibility of intermodal connectivity of transport infrastructure is one of the prerequisites for attracting FDI. It is also a prerequisite for the segregation of the community space, according to the model of a Europe with more interconnection/investment speeds.

The presence of the main intermodal nodes provides the greatest attractiveness to investors, determining the concentration/polarization of FDI and contributing to the economic and territorial divergence in the EU.

Instead, primary intermodal nodes behave as vectors of convergence and cohesion. Their presence has a complementary and compensatory effect, ensuring better accessibility for the areas where major intermodal connections are missing and which can thus hope for better visibility and attractiveness for foreign investors.

This assessment validates the hypothesis that the intermodal connectivity of transport networks, especially at the primary level, is more important than the size of these networks to attract foreign investors’ attractiveness.

The map of EU with more investment speeds highlights two priority space clusters to cover the Union with third order intermodal connections as a prerequisite for more effective FDI attraction: the first priority areas include Croatia, Latvia, Lithuania, Estonia, Slovenia and Slovakia, and the second priority class includes Romania, Hungary and the Czech Republic.

Acknowledgment

This paper was co-financed by The Bucharest University of Economic Studies during the PhD program.

Contributo selezionato da Filodiritto tra quelli pubblicati nei Proceedings “International Conference on Economics and Social Sciences – Challanges and Trends in Economic and Social Sciences Research - 2018”

Per acquistare i Proceedings clicca qui:

http://www.filodirittoeditore.com/index.php?route=product/product&path=67&product_id=149

Contribution selected by Filodiritto among those published in the Proceedings “International Conference on Economics and Social Sciences – Challanges and Trends in Economic and Social Sciences Research - 2018”

To buy the Proceedings click here:

http://www.filodirittoeditore.com/index.php?route=product/product&path=67&product_id=149