Apple’s Business Model in the Context of Internationalization

Abstract

The main purpose of this paper is to create an X-ray of Apple’s controversial business model in the context of internationalization. Fortune states that Apple’s annual revenue in FY 2017 was of $215 B. The Cupertino based company managed to jump from 492nd place in FY 2006 to 9th place in FY 2017 on the Fortune Global 500 list. According to Forbes, in 2017 Apple had a market value of $752 B being ranked as number one. This is a stunning performance for a company that has as main products mobile phones, laptops and more recently watches and intelligent home assistants. In a business environment where user’s retention is directly proportional to the number of the iDevices they have, the main threat for Apple products comes from its very own products. After presenting different types of business models discussed in the literature regarding Apple’s business model, the focus will be on navigating through Apple tech-chain and discussing whether the topic of self-cannibalization is relevant for Apple’s products. Another insight will be also how the store expansion or internationalization improved Apple’s business model. The findings are creating the premises for a better understanding and anticipation of Apple’s expansion strategy by a reader which is not familiar with their ecosystem.

Table of contents

1. Introduction

2. Literature review

3. Reshaping existing business models

4. Research Methods

5. Findings

6. Conclusions

JEL Classification: F20, M20

1. Introduction

The main purpose of this paper is to create an X-ray of Apple’s business model. It is intriguing how a company that sells mobile phones and laptops manages to annually boost its revenue.

This is a consequence of the internationalization, of fact that Apple scores high sales in the first two world’s economies – US and China. In fact, according to Gartner, in 2015, Apple sold more iDevices in China (71.2M) than the US (70.3M). There was no surprise when Apple decided to invest $500M in R&D centers in China, at the end of 2017 (Dunn, 2017).

Apple entered the tech industry by producing desktop computers mainly for productivity and entertainment. Apple I was a great piece of technology that created the room for the next iconic product but the company’s extraordinary growth since 2001 has come from a series of innovative products from the iPod to the iPhone and the iPad that, have made connected digital devices ubiquitous in our everyday lives. (Lazonick et al., 2013)

When it comes to internationalization, there are two big époques in the recent history of Cupertino based company – ante-iPhone and post-iPhone. If back in 2001 Apple had only 8 stores within the United States and in 2007 the number of worldwide stores reached approximately 200, only three years after the launch of the iPhone – in 2010 – the number of worldwide stores almost doubled.

With a mainstream product to sell and the idea that “there’s no better place to discover, explore and learn about our products than in retail.

It’s the retail experience where you walk in and you instantly realize this store is not here for the purpose of selling.

It’s here for the purpose of serving” (Cook, 2013) Apple has perfected a true worship strategy among worldwide users and carriers through scarcity.

A conclusive example would be the long queues formed at each iPhone launch. Apple is requesting special treatment even from carriers.

The so-called Apple corners are present in each carrier store and are imposed and standardized by Apple.

Apple is also very keen on bloatware strategy - banning the modification of the proprietary software included in their products in order to prevent the pre-installation of carrier’s applications (e.g. Cost Control, Top-up).

Even so, according to Dediu (2013), the number of visitors to Apple Stores increased from

25 million/quarter in 2007 to 120 million/quarter in 2012.

Just to extrapolate this means that only in 2012 half of Europe’s population visited Apple Stores.

That’s a perfect example to stress Apple’s ability to extract extraordinary margins due to an ability to maintain high price points by providing a ‘unique’ retail experience (Montgomeriea & Samuel, 2013).

2. Literature review

Introduced by King Gillette, razor and blades is a business model whose central idea was to give away free razors samples and to make a real profit from the high margin on the blades, which is similar to what Apple does with its software and hardware products (Anderson, 2009).

While it may seem a good example, this model has certain flaws. The main weakness of the model is that the protection is granted only by the patent.

The risk is that competitors would find convenient to produce auxiliary products for the patented one.

This was the case of Gillette when the patent expired. In the case of Apple, this strategy applies to mostly to its software.

An example is the patent battle between Apple and Samsung at the launching of the first Samsung Galaxy Phone. The embedded software had similar touch gestures to the ones found on iPhone iOS.

According to Cuofano (2017), Apple uses a reversed razor and blade model because it makes the real profit on its physical products while offering free or low-priced digital products.

According to Reuters (2017), the newest iPhone – iPhone X costs $357.50 to produce and Apple sells it with a $999 price tag.

That’s a 64.21 percent gross margin due to the fact that Apple successfully managed to combine the low-cost manufacture and assembly model of many electronics companies with a luxury brand marketing and pricing strategy (Montgomeriea & Samuel, 2013).

On the other hand, according to Market Watch, in 2017 Apple invested in R&D the equivalent of Albania’s GDP ($11B). This translates into the further development of the proprietary operating system and hardware improvements.

There is also the so-called fishbone business model used hand in hand with iPod Classic according to which Apple partnered with key stakeholders in the music industry in order to create the environment for the direct sale of the overpriced iPod (King, 2012). Currently, this applies to Apple Music platform, the only way of using this service is buying a $99/year subscription.

Even Steve Jobs indirectly underlined that more complex strategies are better than one, declaring that his “model for business is the Beatles.

They were four guys that kept each other’s negative tendencies in check; they balanced each other…And the total was greater than the sum of the parts.

Great things in business are never done by one person, they are done by a team of people” (Isaacson, 2011).

3. Reshaping existing business models

While it can be confusing to talk about various business models implemented by the same company and the way they are applied and interlinked in different situations, paraphrasing Steve Jobs it is safe to say that business is never done by one model, it is done by a mix of them.

All the aforementioned business models were and are used in the different combinations. One may think of the iPhone as an expensive piece of technology that costs three times less to produce than the marketed value but the newer models incorporate another business model – making redundant the existing software/hardware.

After buying Beats Company, Apple Inc. decided to remove the 3.5 jack connector in favor of a proprietary one. As consequence, all iPhone 7 models and newer no longer have an audio jack so users can use only the proprietary wired lighting headphones or Bluetooth wireless headphones. The same goes with the software.

Usually, Apple drops software support for devices older than 4 years. This was the case of the iPad 3, Apple reporting in 2016 that no updates will be further available for this device, although it had the same hardware as the iPad 4 (except the lightning connector).

A recent tweet revealed that Apple purposely is slowing down old devices without notifying users, just to speed up the upgrade to a newer iDevice.

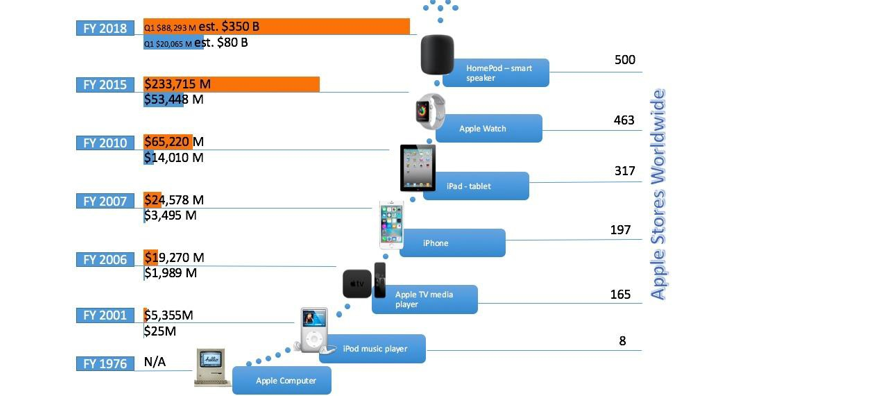

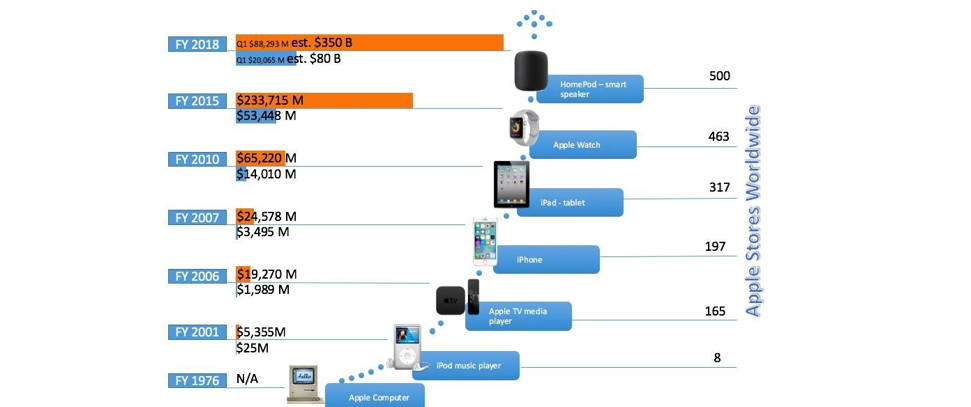

Figure 1 the tech-chain of Apple is correlated with net sales, net income and number of worldwide stores. It is called in this manner considering the fact that each and every new product was meant to fill a gap in the industry caused by the previous one.

Source: Data for Apple tech-chain was adapted from Apple (2015). Data for Apple financial statements were collected from Apple Investor (2015). Data for number of stores were collected from Apple Storefronts (2017)

After the Sony Walkman revolution, everyone wanted a more compact device that could store a huge quantity of music, without using tapes.

The Cupertino company introduced the iPod – a media player that could download and store a huge quantity of songs.

This astonishing device was introduced together with a more complex business model. After buying this device, the only way to copy songs from/to device was through iTunes software. Practically the users were locked to Apple’s proprietary content.

When the first-generation iPhone was launched back in 2007, the same strategy continued to lure the users.

All the media transfers between the iPhone and a computer were being made via iTunes. The software update and data backup also were iTunes dependable.

Any application was being installed using cellular data/Wi-Fi via AppStore or using the iTunes software.

Despite having Bluetooth any file sharing possibility was disabled and the USB cable had a proprietary form even if back then the mini USB was standard.

When Apple TV – the Apple’s media player – was released it was no surprise that the displayed content is reduced only to Apple ecosystem, any streaming from another device besides the iPhone being excluded.

The iPad was dedicated to those that tasted the flavor of the iOS software on the iPhone and wanted a bigger display to do tasks like reading, watching videos, writing, painting etc.

When it was launched, the iPad lacked also the file sharing possibilities and the mini USB option too. The only port that was aligned to the standards from that period was the 3.5 mm audio jack.

The persistence continues even in current times when Apple is using a proprietary port, different from the initial one, the new standard when it comes to cable connectivity being USB type C. Apple Watch was initially released and marketed as a device for active people or for those who want to enhance the experience on their iPhone.

So it was. The watch could not be connected to other devices besides iPhones and what’s newer – Apple Watch cannot be activated and used without an iPhone.

In certain cases, the watch can extend the functionality of an iPhone; for example, it introduces the possibility to use Apple Pay – Apple’s proprietary payment system - on older devices without near field communication like iPhone 5 or iPhone 5C.

HomePod is the smart speaker/intelligent assistant released in 2018 that can execute various voice-based commands like turning on/off a lightbulb, activating/deactivating the alarm, play music etc.

The experts think that HomePod is the pinnacle of the Apple’s effort to retain users in their ecosystem. Not only that the smart speaker

works just with an iDevice but in order to play music on it – the main function of a speaker – the users must have an Apple Music subscription.

The speaker has no external port whatsoever, so without a subscription, the only sound played by the speaker will be the voice of Siri – virtual assistant.

When it comes to restricting users in such manner, a threat for Apple products is other Apple products. After the iPhone launching, everybody wondered what will be the role of the iPod?

The only advantage of the iPod over the iPhone – the storage – which disappeared in time, leading to it being discontinued in 2017 (Pierce, 2017).

According to Gurman (2017), Apple plans to redesign iPhone and iPad applications too in order to work on MacBook line-up.

If the MacBook has the same autonomy of the battery as the iPad, approximately the same dimensions but the possibility to run iPad apps as well as MacOS apps, the iPad pie slice in the revenue share will be thinner.

The same with Apple Watch and the iPhone.

Recent models of the Apple Watch have a SIM slot and can be used without an iPhone which may lead to a decrease in iPhone sales.

AppStore – another milking cow – was first launched in 2008 and since then Apple has made over $120B in sales (Heisler, 2018). This is mostly due to the crowdsourcing strategy.

The App Store provides developers with a link to users; they set their own price for the application and retain 70% of sales and in-app advertising revenues (Bergvall-Kåreborna & Debra, 2013).

Apple’s platform is a semi-closed-source platform, and authorization is required for an application to be sold in the App Store (Yang et al., 2018).

In the above-presented tech-chain, Apple managed to implement complex types of business models, but the common path is that each and every one has as ultimate goal making users stick to Apple ecosystem.

Currently, it resembles more a zero-sum game where the participants are the Apple products.

Although it started to produce desktop computers almost a half of century ago, the first store beyond the border was opened after 27 years in 2003 in Japan – Tokyo (Spencer, 2012).

However, in the last years, the expansion was exponentially and currently, Apple products can be bought from approximately 500 worldwide stores.

This expansion occurred not only on vertical by growing the number of stores but on horizontal too. Recently, Apple signed partnerships with different companies like Nike and Hermes in order to grow the notoriety of its products in both corresponding sports and luxury niche markets.

Apple Watch is the only product that the company sells in luxury, sports and standard version. The same watch has a starting price of $349 for the Nike+ sports version and can reach up to $1399 – the Hermes edition with a leather bracelet (Apple, 2017). All versions share the same internals.

4. Research Methods

The goal of this paper is to make an unbiased analysis of the way the Apple business model was reshaped in the context of internationalization. To examine this, data between 2001 – the launching of the iPod – and 2018 – the HomePod release – was taken into account.

The data related to Apple net sales and Apple net income was collected from the Apple condensed consolidated statements of operations for each respective year, starting with 2001.

The Apple investor database is public and can generate numbers of the last 18 years. The extracted numbers were double-checked with another database – AAPLinvestors.net.

Information related to a number of Apple Stores was collected from the Apple Storefronts database, a project that presents each and every Apple Store by the date of the opening and location.

It the Apple tech-chain chart some of the Apple products like MacBook, MacBook Air iMac, iMac Pro, iMac Mini are missing, those being assimilated to Apple Computer. The same goes for the iPod Nano, iPod touch, iPhone X and older, those being assimilated to the iPod and iPhone category.

The decision to focus only on the main products has been made in order to avoid the misunderstanding of the core ideas by unfamiliar readers.

5. Findings

One key finding of the study is that there is a direct link between Apple’s user retention and the number of devices they have. If at the beginning one had the possibility to simply switch to a Sony USB Walkman instead of using the iPod in current times Apple is making life hard for users that want to migrate to other platforms.

Another finding is the fact that Apple internationalization strategy was not linear.

The number of Apple Stores simply boomed just after the increasing demand of first-generation iPhone, when they saw the potential and when they were confident that the product is mature enough and can cope with the fierce competition.

An interesting finding is that for the moment, an important competitor of an Apple product is another Apple product.

Having in mind cannibalization between the iPhone and the iPod it remains to be seen how the remaining products will get along.

6. Conclusions

The main aim of this paper is the examination of the Apple’s complex business strategy, correlated with the worldwide expansion.

There were presented examples of the incipit strategies all the way down to the user’s aggressive retention to Apple ecosystem.

This paper created also the premises for a future understanding and anticipation of the Apple expansion strategy by a reader which is not familiar with their ecosystem.

The study has some limitations related to the period used to analyze the business models in the context of Apple’s expansion, due to the lack of data in some periods since the company’s establishment.

However, being a mainstream company, different types of information can easily be found online and analyzed, as well as the multitude of electronic sources.

Contributo selezionato da Filodiritto tra quelli pubblicati nei Proceedings “International Conference on Economics and Social Sciences – Challanges and Trends in Economic and Social Sciences Research - 2018”

Per acquistare i Proceedings clicca qui:

http://www.filodirittoeditore.com/index.php?route=product/product&path=67&product_id=149

Contribution selected by Filodiritto among those published in the Proceedings “International Conference on Economics and Social Sciences – Challanges and Trends in Economic and Social Sciences Research - 2018”

To buy the Proceedings click here:

http://www.filodirittoeditore.com/index.php?route=product/product&path=67&product_id=149