Challenges and Opportunities for Setting Up Start-Ups in Romania in 2018

Abstract

The special role and importance of SMEs in national economies have been largely reflected in a broad scientific literature, as a result of the concerns of theoreticians and practitioners in the field.

The European Union, as an economic and political integrated area, pays special attention because there are approximately 23 million SMEs that comprise 99% of all enterprises and provide most of the jobs in the EU. As a member state in EU, Romania try to encourage SMEs development in each economic branch and has particular policies regarding creation, financing and legislative and administrative support. Present paper tries to highlight the importance of supporting start-ups in Romania; the changes in the economic and financial environment as well as the conditions of setting up new firms.

Table of contents

1. Literature review

2. Developments for start-up businesses in Romania

3. Challenges and opportunities for new business in Romania

4. Hierarchy of challenges or external constraints

5. Conclusions

1. Literature review

As a result of the theoreticians and practitioners’ researches. the special role and importance of SMEs in national economies have been largely reflected in a broad scientific literature.

In the paper “Sustainable Entrepreneurship in SMEs: A Business Performance Perspective”, the authors conduct a study that “brings forward the exploration of sustainable entrepreneurship using an important statistical tool which is still less known and valued by researchers in developing countries” and also “stresses the advantages of using PLS-SEM in testing, measuring and evaluating research models in various organizational frameworks” [1].

Important issues regarding start-ups concepts and their importance in European Union are highlighted in Herte’s work “SMEs and Start-Ups. Importance and Support Policies in European Union and Romania” [2].

A research in order to reflect the Romanian SMEs transition to the Knowledge Based Economy (KBE) represents the paper “Analyzing SMEs transition towards Knowledge based Economy: an investigation on the SMEs from the south region of Romania” by Popa [3] which analyzed by implementing “a structured questionnaire on 317 SMEs from the south region of Romania [...]: the importance of acquiring/obtaining, protecting and valorizing the knowledge; increasing the knowledge based as a strategic direction; the importance of intangible assets; the partnership with their key stakeholders; participation in various forms of collaboration between firms; the investments in training; the characteristics of the motivational system; the flexibility of work”.

Berger and Udell (1998) [4] underline the significance of “the ‘life cycle paradigm’ for SME financing decisions” as “bank loans and trade credit account for 70% to 80% of total financing for SMEs, independent of firm size and age” regarding the United States SMEs.

Another research on SMEs financing is that of Huyghebaert and Van de Gucht (2007) [5] which shows an increase use of debt financing for Belgian SMEs start-ups along with the risk of paying back on short notice.

Regarding Romania, financing SMEs start-ups by banks remains an intricate problem as Boscoianu et al., (2015) [6] punctuate: “The problem of SME manufacturing financing is already chronic in Romania.

The banking system, on the one hand, still fails to sufficiently understanding on these projects, on the innovative character and the work model with intangible assets. On the other hand, the stock market is inaccessible for this type of investments”.

2. Developments for start-up businesses in Romania

Romania, as a country with a population of 19,705,301 habitants, a GNI per capita of US$ 9,470 and an upper middle income, registered a Rank of 45 out of 190 for Doing Business indicator of World Bank in 2018 as a measure for the previous year [7]. That shows a particular evolution for Romania from a Rank of 45 in 2009, 55 (2010), 65 (2011), 72 (2012), 72 (2013),73 (2014), 48 (2015), 37 (2016) and 36 in 2017, meaning a worsening of business conditions during the crisis and then the recovery of the economy and the return to better conditions.

The World Bank methodology for ranking economies takes into account as major components the following: Starting a Business, Dealing with Construction Permits, Getting Electricity, Registering Property, Getting Credit, Protecting Minority Investors, Paying Taxes, Trading across Borders, Enforcing Contracts and Resolving Insolvency [7]. Romania ranks between Czech Republic (rank 30), Moldova (44) and Hungary (48), Bulgaria (50) in its region.

Also, the indicator for Starting a Business component has decreased from 62 in 2017 to 64 in 2018 in terms of procedures, time, cost and paid-in minimum capital.

Considering the competitiveness in Romania analyzed by World Economic Forum thorough “The Global Competitiveness Index 2017-2018 edition” the most problematic factors for doing business are represented by tax rates (13.0), inefficient government bureaucracy (12.9), access to financing and inadequately educated workforce (11.9) and also corruption (11.7) and inadequate supply of infrastructure (10.1) [8].

In this regard, Romania registered a Global Competitiveness Index of 62 out of 138 for 2017/2018 with a stationary situation as compared to 2016/2017 and a decreasing trend for 2015/2016 (53) and 2014/2015 (59), having a good score for Macroeconomic environment and health and primary education (5.5) and a bad score for Institutions, Infrastructure and Business sophistication (3.6) and Innovation (3.1) [8].

A study called “Start-up business barometer of Romania” by Ernst and Young Romania reveals important particularities regarding the Romanian start-up ecosystem and the Romanian start-up entrepreneur, the Profile of the start-up entrepreneur, Entrepreneurial education, Access to finance for start-ups, Regulation and taxation, Coordinated Help-Contribution of associations to support entrepreneurship, Entrepreneurial culture and Demographic data [9].

Looking at the profile of the start-up entrepreneur some characteristics standout such as: individuals who work hard to have their own business – an average of 9.2 h/day; individuals at the starting point – 45% of them lead a start-up by less than one year old; individuals willing to take risks alone, but also in partnership – 48% of respondents are associated with at least one co-founder in the business; individuals who use their own funds as basic funding – 78% of them started their business with their own funds (savings, personal loans, salary) [9].

Regarding the question “What do you think is the most important obstacle for entrepreneurs in starting and developing a business in Romania?” the first three important answers were: poor education – 23% in 2017 compared to 16% in 2016; access to finance – 18% in 2017 compared to 17% in 2016 and mentality and fear of failure – 13% in 2017 to 12% in 2016.

The analysis also revealed that the source of funding used to a greater extent to commence the start-up for a Romanian entrepreneur was: own funds (savings, personal loans, salary) -78% in 2017 compared to 71% in 2016; European funds – 10% in 2017 to 11% in 2016; family and friends – 5% in 2017 to 4% in 2016; non-reimbursable funding from the Romanian government or other institutions – 4% in 2017 to 6% in 2016; business angels – 1% in 2017 as in 2016; sponsorship – 1% in 2017 compared to 2% in 2016; others (grants, crowdfunding, supplier credit) – 1% in 2017 to 5% in 2016 [9].

As answers to the question “What are the three most important funding tools that would have the biggest impact in supporting long-term entrepreneurial initiatives in Romania?” for 2017 there were: government start-ups programs – 23%; European funds – 17% and Business angels– 12%.

The biggest challenges for start-up entrepreneurs are to provide funds to increase the number of employees (67% find it very difficult or difficult to do so) and ideas for growth during the start-up (62% find it very difficult or difficult to do so) [9].

Regarding the sector in which the start-ups initiate the business the first four places are occupied by: a) IT, software, internet and tech – 27%; b) media and advertising – 11%; c) services for business – 10% and d) retail or wholesale – 10%.

As a general information concerning the research is that of the 406 entrepreneurs who answered the questions of the Romanian Start-up Business Barometer, 88% of them run businesses less than three years old.

3. Challenges and opportunities for new business in Romania

The Romanian business environment has experienced a series of transformations due to influences coming from politics, the economic sector or the social environment, so that at present, Romanian entrepreneurs who want to open a business must take into account the requirements that have emerged and the implications of these changes, especially on business performance in terms of profitability and relative predictability.

Thus, on a political level, on domestic affairs, it can be highlighted the following threats or challenges: applying changes in the laws of justice with implications on the normal functioning of institutions and fight against corruption at the highest levels; the incorporation and/or political subordination of central and local government officials; the non-implementation in practice of the elements of the governance program promised by the political forces and, in particular, those concerning the implementation of the infrastructure.

At the external level: organizational and institutional reconfiguration of the European Union organisms following BREXIT; important alterations in the reconfiguration of policy power poles worldwide, but especially at regional level; reorienting political actions and decisions across many European countries on migration policy, protecting the domestic workforce, ensuring internal security and borders; constantly struggling to provide vital energy resources for state existence and development.

In the economic field, domestically there are: worsening of some macroeconomic parameters: increasing the level of inflation (5.40% June 2018/June 2017) against a 2.50% target for the inflation rate of the NBR in 2018; declining consumer confidence (from – 12.4 points, in Q1 2017 to – 25.8 points, in Q1 2018); the decrease in the number of employees (from 3.40% in T1 2017 to 2.50% in Q4 2017, annual variation); the increase in unitary cost of labour force (from 9.9 in T1 2017 to 12.5 in T4 2017) [10]; the increase of the RON/EUR exchange rate (from 4.5714 lei/euro to 4.6611 lei/euro) [11]; the sudden changes in the fiscal domain that impinge on the forecasting and budgeting of a business and the more of a start-up; although the increase in aggregate demand can be considered auspicious to ensure economic growth, this should rather be seen as a pressure on the current account deficit as a result of increased imports at the expense of exports; the low level of long-term investment in infrastructure, health, education, and last but not least foreign investment.

At the international level: the process of leaving the European Union of Great Britain and the establishment of new trade agreements; the persistence of low inflation in spite of the expansive measures of large-scale monetary policy [12]; the risk of adopting protectionist policies in world trade and abandoning economic agreements and inter-state cooperation previously assumed; sustainability of public and private debt continues to be an important issue in the EU and the euro area [12].

In the social field: poor training and qualification of the workforce; decreasing the number of scholarships; early school leavers; decreasing the number of high school graduates with baccalaureate compared to the total number of high school pupils; the need to observe new provisions in the Labor Code regarding employment and salary on different levels of the labor force.

In the technological field: global trade trends in the context of automation, recommending support for workers who have lost their jobs due to technological change, facilitating employment in emerging industries, promoting labor mobility in the EU, and improving economic growth inclusive [12] (rap on the stability of the NBR June 2018); the emergence of technology innovations in financial and virtual coins.

The opportunities are also reflected on the same level, and although they are presented to a lesser extent, they have a bearing on the start of a business.

In this respect, the political field is highlighted by: the survival in the structures and bodies of the European Union and NATO. In the economic level: the increase of economic growth of 6.9% in 2017; aggregate demand growth, but only to the extent of increasing demand for domestic products; the continuation of the possibility to ensure the financing of investment projects by domains established through the European structural and cohesion funds provided by the European Union; a reduction in income tax as of 1 January 2018 from 16% to 10% for all categories of taxable income, except for dividend income for which the 5% quota is retained; the full passage of mandatory social contributions to the pension fund and social health insurance for the employees, the calculation and the withholding of the employer’s return; the existence of exploitable natural resources with advantageous opportunities for foreign investors and with impact on the Romanian investors through the phenomenon of diffusion of effects and mobilization of resources.

In the social field: the need to attract well-trained human resources professionally through appropriate benefits; the possibility of improving the employees at the workplace or through specialization courses.

Regarding technological level: unrestricted and increasingly widespread access to the Internet and social media through increasingly advanced technologies; bringing new and performing technologies together with foreign investments made in different regions of the country.

4. Hierarchy of challenges or external constraints

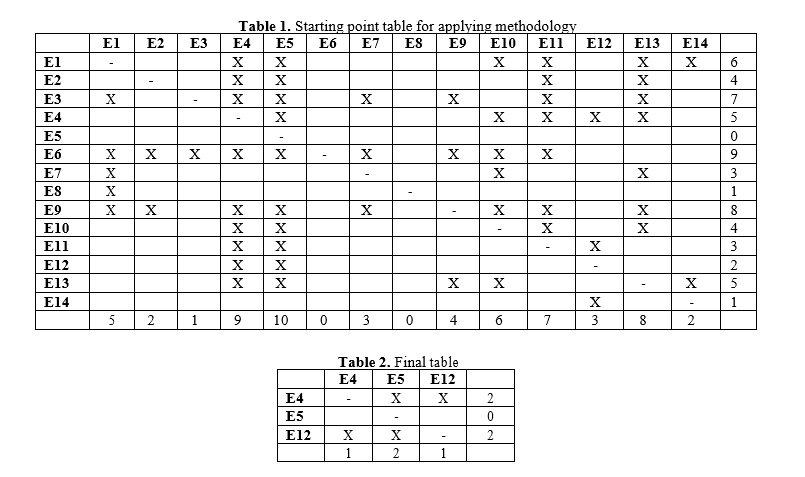

The author has selected a number of 14 external constraints (challenges/threats) in order to highlight their degree of impact on starting new business in Romania. The methodology of research consists of applying successive steps to highlight the importance of each external constraint on others and ultimately on the start-up itself.

The procedure implies: drawing a table with all the constraints by lines and by columns; taking into consideration the first line constraint and analyzing what influence has on the other constraints, putting degrees and totalizing by lines and by columns; the analysis is repeated with all the external constraints; the lines with the greatest degrees correspond to the strongest constraints that influence the others; the columns with the greatest degrees correspond to the weakest constraints that are influenced by the others.

The fourteen external constraints selected and numbered by the author are: a) Economic constraints: E1-Increased rate of inflation; E2-Taxation unpredictability; E3-Lack of sound strategies for different sectors; E4-Reduced level of investments; E5-Brexit and institutional changes in the European Union; b) Political constraints: E6-Legislative changes and unpredictability; E7-Corruption in local and central administration; c) Financial constraints: E8-low development of capital market; E9-high level of insolvency; E10-the increase of the bank loan interest rates; E11-level of public debt and deficit; d) Market constraints: E12-low level of utilities concerning costs and substructures; E13-poor level of economic strength of Romanian companies; E14-market orientation towards price instead towards quality.

Applying the methodology above and by successive elimination of each external constraint in the order of its importance, the author obtains the following string of results: E6 – E8 – E3 – E2 – E7 – E9 – E1 – E13 – E14 – E10 – E11 – E4 – E12 – E5. That way, E5 is the less important external constraint in the author’s opinion regarding setting up start-ups and doing business in Romania.

This constraint E6 not only influences all the rest of them but is the main obstacle in trying to be aware of signals of the economic environment and to reduce some negative ascendancies of external constraints.

5. Conclusions

The Romanian business environment has experienced a series of transformations due to influences coming from politics, the economic sector or the social environment, so that at present, Romanian entrepreneurs who want to open a business must take into account the requirements that have emerged and the implications of these changes.

After highlighting the importance of supporting start-ups in Romania and also the changes in the economic and financial environment as well as the conditions of setting up new firms, the author applies his own methodology in order to show some important challenges (external constraints) for an entrepreneur to create a start-up.

Applying the methodology, the author obtains a string of results as external constraints in their order of importance, from the most to the less important one, and so, the constraint E6 is shown as the most important and not only influences all the rest of them but is the main obstacle in trying to be aware of signals of the economic environment and to reduce some negative ascendancies of external constraints.

Contributo selezionato da Filodiritto tra quelli pubblicati nei Proceedings “International Conference on Economics and Administration - 2018”

Per acquistare i Proceedings clicca qui:

http://www.filodirittoeditore.com/index.php?route=product/product&path=67&product_id=149

Contribution selected by Filodiritto among those published in the Proceedings “International Conference on Economics and Administration - 2018”

To buy the Proceedings click here:

http://www.filodirittoeditore.com/index.php?route=product/product&path=67&product_id=149