Fintech as an engine for innovation and diversified sustainable growth

Abstract

The financial crisis of 2008-2011 and the evolution of IT have led to the transformation of the financial industry in ways that we could not anticipate before the crisis. A new term, fintech, has emerged, which incorporates new technologies used in the financial field, impacting the business world as a whole. The paper aims at exploring how well EU member countries (in particular those in the Central and Eastern EU) are prepared to cope with and use these technologies to develop their own alternative financial market in a sustainable manner under the conditions of a political evolution and economic turbulence in the area.

Table of Contents:

1. Fintech and disruptive financial innovations

2. EU financial market development – challenges and opportunities

3. Dynamics of alternative finance market in CEE countries

4. Conclusions

1. Fintech and disruptive financial innovations

Due to the fact that the world economy has experienced a major financial crisis in 2008, which has led to a drastic decrease in confidence in traditional financiers and, against the background of increased risks, entrepreneurs have faced increased funding costs, which has led to the search for new financing alternatives and financial intermediation. This has led to the development of this “new sector in the finance industry that incorporates the whole breadth of technology that is used in finance to facilitate trades, corporate business or interaction and services provided to retail consumers” [1]. For Puschmann [2], fintech is an ‘umbrella term’ encompassing innovative financial solutions enabled by IT, while Dorfleitner et al., [3] has classified operations in this area as being related to financing, asset management, payments, and other innovative elements that allow interconnection of the domain and better customer service.

Giving the interest in the newly emerging field, in March 2017, also the European Parliamentary Research Service described it in a brief glossary terms, where payments, financial research, insurance, deposit & lending, investment management and crowdfunding are the main components [4]. Stakeholders have found that the financial system has its limits and fragility when confronted with a major crisis [5], and traditional financial instruments and operations are no longer able to meet financing and investment needs. For this reason, there was a need for innovative financial instruments, based on some of the traditional features that, in order to be imposed on the market, had to meet additional cost, efficiency and reliability requirements, being grafted on elements of technology information.

This is the case for crowdfunding, crowdlending, or crowd investing electronic finance platforms that challenge the banking environment forcing it to rethink both its lending and investment strategies and, more importantly, its client policies. If access to finance is usually based on the debtor’s history and a creditworthiness analysis, with funding being provided mainly by banks, from attracted deposits, multi-funding platforms use the power of social networks to attract funding sources and analyze of real-time venture entrepreneurs who want to get money for their businesses. Moreover, due to networking-based operation, these platforms also offer notoriety to projects seeking funding through them.

From now on, anyone can be a financier, even with symbolic amounts and many more new entrepreneurs may feel encouraged to develop projects they can upload on these platforms to find support in their realization. In the same logic, collections and payments, which traditionally were made through banks as trustworthy intermediaries, are starting to grow more directly between the parties involved thanks to blockchain technology, which allows tracking, authentication and securing the entire process. Moreover, this technology generates new financial products, so-called crypto-currencies (bitcoins, Ethereum, etc.) that promise not only new ways of payment, but also new investment opportunities and gains. And when we talk about the investment-earnings relationship, we find it more and more common that financial asset management methods are now increasingly based on artificial intelligence, robo- advisers being the term used to describe these new financial advisers who are capable of realizing optimized real-time portfolios management.

2. EU financial market development – challenges and opportunities

Given the current development, fintech leads to the emergence of a new component of the financial market, referred to in the statistics as “alternative finance”, perceived by many as being like “genie out of the bottle” [6]. If in 2012 the total value in the EU was € 487m and rising explosively over the next four years (reaching 7.671 mil euros in 2016), although for the period

2019-2022 a growth mitigation was estimated, it will remain extremely promising: an annual growth rate (CAGR 2019-2022) of 15.3% resulting in the total amount of € 3,152.4m by 2022 ([7], [8]).

Although there are many development opportunities, the expansion of the EU’s alternative financial market also faces many challenges in the era of digital transformation ([9], [10], [11], [12]). The analysis of trends in fintech development shows its disruptive potential in areas such as saving and investing, obtaining financing, paying and transactions security. The STEP analysis of the fintech field at European level shows that the challenges it faces have socio-economic and legal roots, as well as technological, namely:

(a) Social factors: the perception of potential users about innovative financial instruments is rather prudent (due to lack of information, trust and/or education, and the potential for transparency of transactions through the use of these technologies, capable of indicating the origin and destination of payments); the change of the business paradigm (development of social affairs, sharing business, use of social network force to promote projects and get funding);

(b) Technological factors: use of information technology to create new financial instruments and products (electronic finance and investment platforms, virtual coins, blockchains, robo-advisors), but also for cyber-attacks on traditional or new financial operators or for other offenses financial (money laundering);

(c) Economic factors: the increasingly aggressive expansion of the other major economic powers of the modern world in fintech: the US and China, followed closely by countries such as India or Hong Kong or Singapore (see Figure 4), combined with the pressure felt more and more to correlate with new business models developed by firms with fulminant ascent (so-called unicorns) in areas such as bio-economy, bio-medicine, IOT or AI;

(d) Policy and legislative factors: the need to create a uniform regulatory framework for these new tools, technologies and financial operations for all EU countries [13]; the uncertainty about the UK’s place and role in the EU, as this is currently the largest fintech market in the EU (26.9% in 2016).

In the EU, fintech development is related to a series of challenges and opportunities, namely: (a) Insufficiency and inadequacy of the traditional financing sources at the clients ‘disposal,

respectively banks’ reluctance to finance SMEs during and after the financial crisis, due to the high business risks of the latter;

(b) the need for faster access to financing and to the cashless operations of stakeholders; (c) fluctuating returns in the traditional banking industry since the crisis began in 2008; (d) increasing the number of native digital users and changing customer behavior;

(e) the emergence of new IT applications for the financial sector and new devices and hardware architectures, as well as the creation of new methods of transmission and processing of information (information technologies using 5G transmission);

(f) the perception of the democratization of the access of the financial market participants; (g) reducing financing costs by automating some operations;

(h) the possibility of obtaining new gains from innovative financial instruments;

(i) changing the business models of financial intermediaries (automation, blockchain technology) and, as a consequence, a reducing of the density of banking branches in the territory.

Financial processes are rapidly automating and lead to changes in the number and structure of staff in the financial and banking field. There are and are already being used the technologies through which they can process huge amounts of data in order to assess the creditworthiness of their clients, to calculate their social scoring (China’s case) or to offer their clients the best savings/investment alternatives, which has already led to changes in the skills required for financial and banking staff and to adjustments to the number of people employed in the field.

According to Eurostat, at the EU level, the decrease was 5.09% in 2009-2017, but it had different dynamics in the member countries of the Union: rather decreases in the old countries of the union and increases in the newly admitted (members since 2004). Also, new fintech technologies lead to a cashless world in which payments are made more and more from mobile applications, which has implications for both the speed of transactions and their security.

Worldwide, in China in 2018, transactions amounting to 179,507 million euros were made, in the US 110,388 million euros, while in Europe the market leader (UK) recorded mobile payments of only 20,942 million euro. A Capgemini report [14] links the evolution of non-cash transactions per capita to the corruption perception index, showing that Western European countries with low levels of corruption record high values of the number of electronic payments per capita, respectively greater transparency of transactions. CAGR 2016-2021 of EU for non-cash transactions is 6.8% lower than that of mature Asian markets that is 9.9%, which indicates both a higher appetite for financial IT and the potential of future business development in this area.

3. Dynamics of alternative finance market in CEE countries

Due to the spectacular development of fintech globally (mainly in the US and China) in front of the European financial market is now a huge challenge, linked, on the one hand, to its ability to innovate, and, on the other hand, use new business models and gain from the use of new fintech products, services and technologies. Fintech’s development in Europe is uneven, with the UK being the main actor, followed by Germany, France and the Nordic countries. In the new member countries, the market leaders are Estonia and Poland, at the opposite side being Romania.

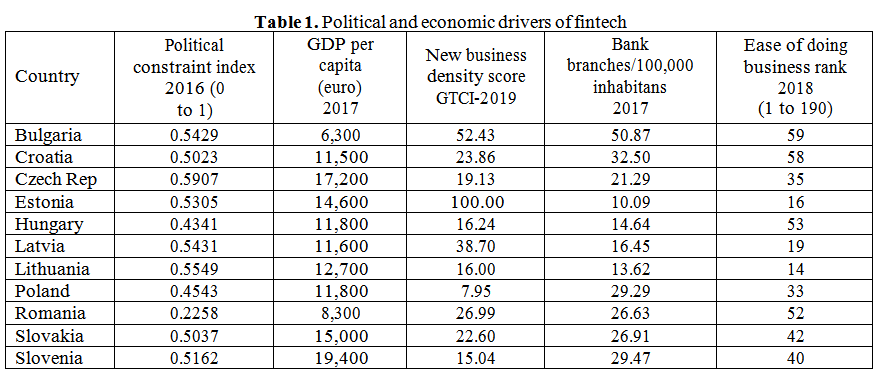

To understand the dynamics of these developments, it is necessary to analyze how STEP factors contribute to business development in this area. A first factor is related to political and legislative issues, as to how much openness and support there is to investors. To understand the evolution of political constraints on the business environment and, implicitly, on fintech entrepreneurship, we suggested the analysis of the POLCON index (political constraint index) [15]. The more the value of this index is closer to 1, the greater the freedom of decision of the economic agents, which are less constrained by the political decisions made by the legislators. (see Table 1). The economic factors that we consider relevant to be included in the analysis of fintech field understanding in CEE countries refers to how the nation’s wealth is distributed (using GDP per capita as a proxy), the new business density score, the banking penetration rate (the bank branches per 100,000 inhabitants as proxy), as well as the easy ease of doing business index (see Table 1).

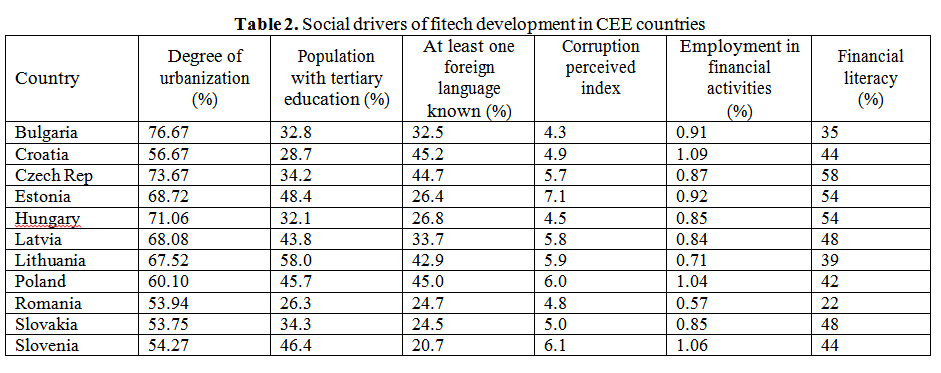

Understanding the social aspects of fintech development in CEE countries is of interest in terms of access to social resources and particularly to education, ability to connect with people in other cultures, understanding of business world rules, and financial involvement. For this we propose the analysis of the following social factors: progress in social development (using urbanization rate as a proxy), higher education access rate, foreign language knowledge for those in 24-64 age, corruption perceived index (where 0 is the most corrupted), employment in financial activities and financial literacy (see Table 2).

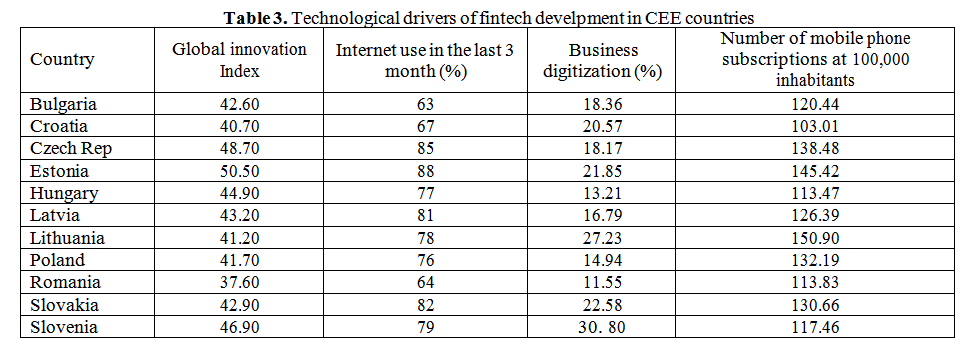

Not least, fintech’s development is closely linked to the development of information technology [16], which can be defined and analyzed through factors such as: global innovation index (as a measure of a country’s ability to develop various technologies, including information technology), internet connection rate, penetration of business information technology (using business digitization rate as a measure), and the number of mobile phone subscriptions at 100,000 inhabitants (see Table 3).

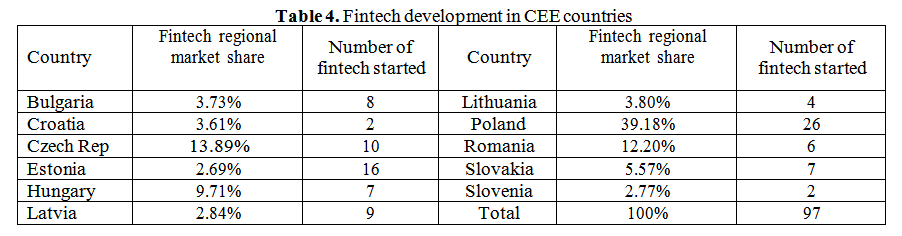

Data from Statista [7] indicated that the local CEE market is dominated by Poland and Czech Republic, followed by Romania, in term of market share, but a closer look at he number of fintech companies started in each of ceE countries shows a different picture with Poland and Estonia, followed by Czech Republic as the most active playes (see Table 4).

Within the group of analyzed countries, we consider that the external environment influences the development of the fintec domain, as were calculated in the correlation’s matrix. The number of fintech companies correlates significantly positively with a low corruption perceived index, internet-use and mobile subscription, and negative with business digitization and ease of doing business score. Therefore, fintch businesses are present and blooming where there is a low degree of penetration of business information technology and where there are obstacles to traditional business development, thus allowing faster capital gains, financial investment and ease of payment. This must be judged in conjunction with the characteristics of the population in those countries, as such businesses are in direct correlation with a low degree of corruption and a good spread of the use of information technologies (Internet and mobile applications).

The correlation matrix indicates that the reduction of the political constraint index correlates positively with a higher degree of urbanization (0.5008), with a better understanding of the financial field in terms of employability (0.4911) and financial literacy (0.6642), but also with the improvement of perception with regard to the level of corruption (0.3503). The latter correlates positively (0.5922) with the rise in the standard of living (GDP per capita) and strongly negative (-0.8411) with ease of doing business. The more a country is perceived as more corrupt, the more difficult it is to develop. As the degree of information technology development is lower, the harder to develop business in the country (-0.7345). Also, an increase in financial literacy leads to improved perception of corruption reduction (0, .3712).

4. Conclusions

If we look at the development of the fintech field through the STEP model we observe that certain factors are determinants in understanding the emergence and development of companies in this field. The solution for a sustainable development is given by the analysis of the analyzed correlations, which shows that an increase in the number of fintech firms correlates positively with the increase of the standard of living (0.1953), but a sustained effort is needed in the field of financial education, access development to information technology, but also to support innovation to greatly improve the welfare of a country. An educated population will know how to use the resources of new technologies better and will be able to develop high-digitization business and thus contribute to the development of fintech as part of a sustainable development economy.

This is primarily the case for Poland’s economies (the largest regional market) and Estonia (the most dynamic market). As far as Romania is concerned, we have a classic example of a country that is very active in IT, but because of a low rate of financial literacy it still fails to reach its finest development potential.

Contributo selezionato da Filodiritto tra quelli pubblicati nei Proceedings “3rd International Conference Inclusive and Sustainable Economic Growth. Challenges, Measures and Solutions - 2019”

Per acquistare i Proceedings clicca qui.

Contribution selected by Filodiritto among those published in the Proceedings “3rd International Conference Inclusive and Sustainable Economic Growth. Challenges, Measures and Solutions - 2019”

To buy the Proceedings click here.